Investor Relations Performance Trends

March 2026 term 3Q

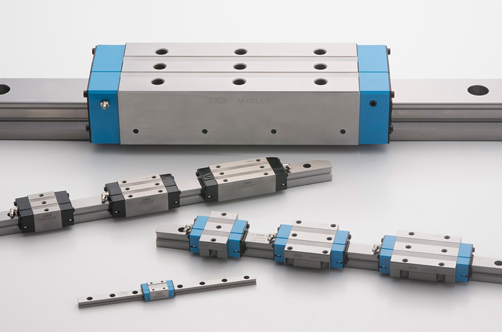

The Group entered the second year of its “IKO Medium-term Business Plan 2026 Connect for Growth —The Future of Innovation, Connected by IKO—.” Based on the key themes of focusing on enhancement in areas of strength and rebuilding our global business structure, we have worked on measures to tackle our key challenges.

From a sales perspective, we actively participated in trade exhibitions in Japan and overseas, deepened business relationships with existing customers, and cultivated new markets and customers. At the same time, we continued to spread information using social media in an effort to ingrain the IKO brand in the market.

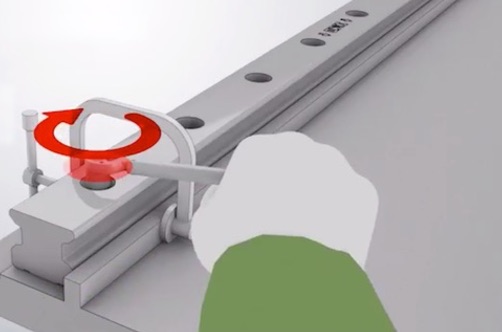

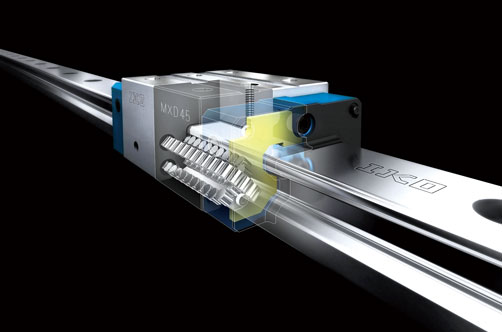

In terms of product development, we enhanced our lineup of high-value-added products that meet customer needs by adding absolute encoder specifications to our mechatronics products Nano Linear NT…V and Alignment Stage SA…DE/T. Furthermore, our Parallel Drive Stage PD…S (released in December 2024), which features a low-profile design with our unique actuator mechanism, received the Electrical & Electronic Component Award at the 2025 “Cho” Monodzukuri Parts and Components Awards.

From a production standpoint, we advanced the improvement and optimization of the production function of our bases in Japan and overseas with the aim of achieving a responsive global supply system.

As a result, consolidated net sales for the nine months ended December 31, 2025 totaled ¥45,646 million, up 13.3% year on year. On the earnings front, due to some factors such as the effects of the increase in net sales and increase in production volume, operating profit was ¥2,361 million, up 242.2% year on year, ordinary profit was ¥3,142 million, up 137.3% year on year, and profit attributable to owners of parent was ¥2,971 million (compared to loss attributable to owners of parent of ¥211 million in the corresponding period of the previous fiscal year).

Consolidated Balance Sheets

Total assets as of December 31, 2025 totaled ¥121,760 million, an increase of ¥653 million compared with the end of the previous fiscal year. This mainly comprised increases in notes and accounts receivable - trade of ¥2,044 million and investment securities of ¥2,161 million as well as decreases in cash and deposits of ¥1,119 million and inventories of ¥2,507 million.

Total liabilities amounted to ¥41,041 million, a decrease of ¥3,993 million compared with the end of the previous fiscal year. This mainly comprised an increase in notes and accounts payable - trade of ¥643 million as well as a decrease in long-term borrowings of ¥4,617 million.

Total net assets amounted to ¥80,718 million, an increase of ¥4,646 million compared with the end of the previous fiscal year. This mainly comprised increases in retained earnings of ¥1,392 million, valuation difference on available-for-sale securities of ¥1,533 million, and foreign currency translation adjustments of ¥1,693 million.