Sustainability ESG Management: Governance / Corporate Governance

Basic Approach

We believe that one of our priorities is facilitating prompt and effective decision making, enhancing supervision of business execution, ensuring compliance and increasing management transparency to achieve sustainable growth and improve corporate value over the medium to long term under a basic management policy of continuing to develop together with society by promoting corporate activities in consideration of our social mission and pursing developmen of technologies to meet user needs and preservation of the environment globally. Based on this belief, we will enhance corporate governance.

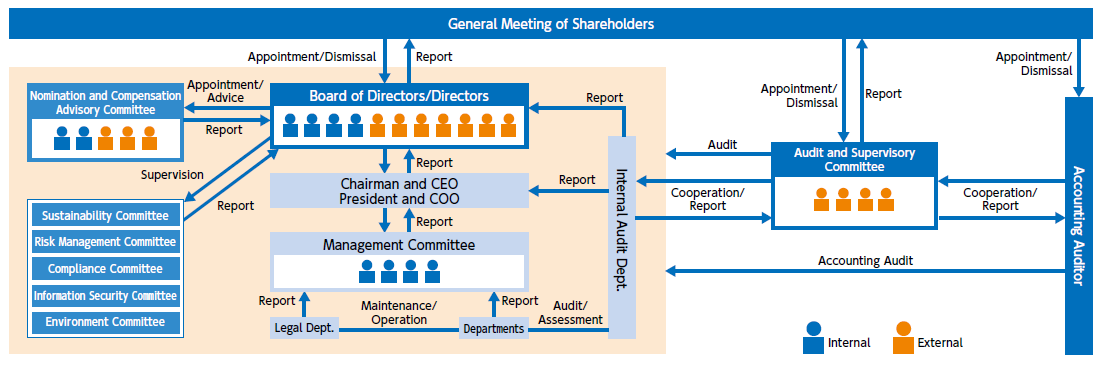

Corporate Governance System

Upon approval at the 76th Ordinary General Meeting of Shareholders on June 27, 2025, Nippon Thompson transitioned from a company with an Audit & Supervisory Board to a company with an Audit and Supervisory Committee. We decided to make this transition to the new structure as a means of making our management decision-making process and execution of business faster and more efficient. We also believe that having Audit and Supervisory Committee members, whose responsibilities include auditing the execution of duties by Directors, as board members with voting rights will boost the supervisory functions of the Board of Directors, further strengthening and enhancing our corporate governance system, which should add to our corporate value.

Corporate Governance Structure

| Organization | Board of Directors | Audit and Supervisory Committee | Nomination and Compensation Advisory Committee |

Management Committee |

|---|---|---|---|---|

| Composition | 11 members (4 internal + 7 external) * Chaired by the Chairman and CEO |

4 members (4 external) * Chaired by a full-time Audit and Supervisory Committee member. |

5 members (2 internal + 3 external) * Chaired by outside director |

4 members (4 internal) * Chaired by the President and COO |

| Objectives | Ensuring efficient execution of duties by Directors | Monitoring and supervising management | Deliberate and report on matters related to nomination and compensation as a voluntary advisory body to the Board of Directors | Prompt management of decision-making and business execution |

| Main Discussion Items | ・Decisions on important management matters ・Supervision of business execution |

・Checks on business execution ・Reporting on the status of internal audits, etc. |

Matters related to nomination and compensation of directors and Audit & Supervisory Board members, etc. | Confirmation of progress against targets and for solutions to issues, etc. |

| Number of Meetings Held (FY2025) |

18 times | 17 times (Audit & Supervisory Board) |

3 times | 40 times |

・In June 2025, the Company transitioned to a Company with an Audit and Supervisory Committee, with outside directors accounting for a majority (63.6%) of the Board.

・Two female outside Directors were also appointed, further improving board diversity.

・In the Nomination and Compensation Advisory Committee, it is necessary the majority of five committee members and the committee chairperson is to be outside director. This requirement ensures the committee's independence and objectivity.

Audits

(1)Status of Audits by Audit and Supervisory Committee

The Audit and Supervisory Committee consists of one Outside Director who is a full-time Audit and Supervisory Committee Member and three Outside Directors who are part-time Audit and Supervisory Committee Members. They attend Board of Directors meetings and other important management meetings. The Audit and Supervisory Committee formulates a plan for audits for each fiscal year and monitors and supervises management by reviewing important documents, exchanging opinions with the President and COO, and visiting major offices and carrying out audits.

Full-time Audit and Supervisory Committee Member Nobuhiro Matsumoto has worked for financial institutions for many years and has considerable knowledge about finance and accounting.

Part-time Audit and Supervisory Committee Member Kazuhisa Hayashida is a certified public accountant and has considerable knowledge about finance and accounting.

(2)Activities of the Auditors and the Audit & Supervisory Board

Upon approval at the 76th Ordinary General Meeting of Shareholders on June 27, 2025, Nippon Thompson transitioned from a company with an Audit & Supervisory Board to a company with an Audit and Supervisory Committee. This section describes the activities of the Auditors and the Audit & Supervisory Board during the fiscal year prior to the transition.

In FY2025, the Company held 17 times of the Audit & Supervisory Board. The attendance of each Audit & Supervisory Board Member was as follows:

Nobuhiro Matsumoto attended 17 times. Taketo Nasu attended 16 times. Kazuhiko Kimura attended 17 times. Kazuhisa Hayashida attended 17 times.

Major agenda items of Audit & Supervisory Board meetings are the formulation of audit policies and audit plans, the sharing of the results of audits of the performance of the Directors, audits of subsidiaries and other information, the appropriateness of the method and results of the accounting auditor’s audit, the exchange of opinions based on interim reports from the accounting auditor and discussion on matters related to accounting procedures.

The main activities of the full-time Audit & Supervisory Board Member are the formulation of a basic audit plan for each fiscal year, visiting and auditing based on the basic audit plan, reviewing related documents, holding regular discussions on audit status with persons in charge of internal audits and the sharing of audit results with the Outside Audit & Supervisory Board Members at Audit & Supervisory Board meeting. The full-time Audit & Supervisory Board Member received reports from the accounting auditor about its execution of duties and requested explanations as needed to ensure proper auditing.

Internal Auditing

An Internal Audit Office consisting of four members has been set up that is independent from operating departments and that is directly supervised by the President and COO for the purpose of conducting internal audits. The Internal Audit Office conducts accounting audits, business audits, efficiency and economic efficiency audits of business execution departments, and evaluates the effectiveness of internal controls related to financial reports based on internal audit plans prepared according to “Internal Audit Regulations,” etc., reports the result of audits to the President and COO, and regularly makes reports to the Board of Directors, Audit and Supervisory Committee.

Regarding coordination for internal audits, audits by the Audit and Supervisory Committee, and accounting audits, the Internal Audit Office and Audit and Supervisory Committee regularly meet to exchange information and tasks for improving the efficiency and effectiveness of audits. Opinions on reports from each audit are regularly exchanged with the Accounting Auditor, and reports are made and discussions held on audits as needed.

Outside Officers

The Company has seven Outside Directors including four Directors who are Audit and Supervisory Committee Members.

Outside officers are expected to provide managerial advice and supervisory functions to the directors from an objective and expert standpoint, and to act on the basic principle of ensuring that there will be no conflicts of interest with general shareholders. The outside officers are considered independent if they or their relatives (within the second degree of kinship) have not fallen under the following items in the past 10 years.

- Executives at the Company, its affiliates, major shareholders, major business partners, or companies for which the Company is a major partner

- Non-executive directors or accounting advisors at the Company’s affiliates

- Consultants, accounting experts or legal experts who receive significant amounts of cash or other property other than executive compensation from the Company

- Directors or other executives at organizations that receive donations or financial support exceeding a certain amount from the Company or its affiliates

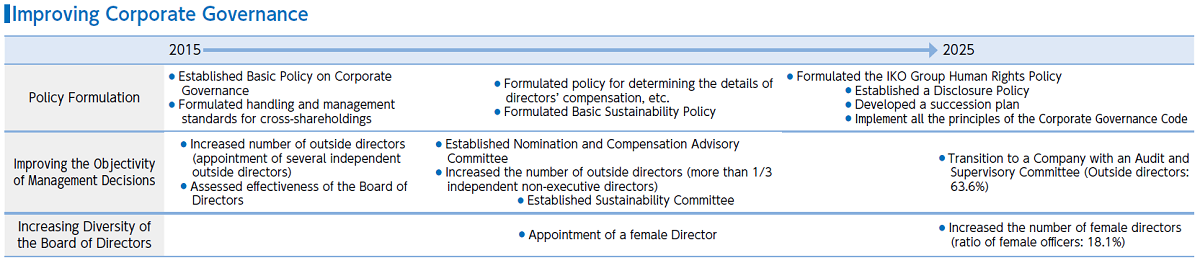

Improving Corporate Governance

Assessing the Effectiveness of the Board of Directors

We conduct an annual evaluation of the Board of Directors to verify whether or not the Board is functioning effectively and to further strengthen its effectiveness for achieving sustainable growth and for improving corporate value over the medium to long term. The evaluation is based on questionnaires and interviews; the results are discussed by the Board of Directors.

| Evaluation and Analysis Methods | ・Conducted evaluation questionnaires for all Directors and Audit & Supervisory Board members ・Individual interviews with each officer by the President and COO, who chairs the Board of Directors |

|---|---|

| Summary of Evaluation Results for FY2025 | ・Confirmation that the Board of Directors as a whole is effective ・The environment fosters free and open comments from external officers, creating a healthy and relaxed atmosphere for lively discussions |

| Improvements from Previous Year | ・Sustainability initiatives ・Enhance training opportunities for directors |

| Future Challenges | ・Improving the way meetings are conducted to revitalize the deliberations of the Board of Directors ・Ensuring greater diversity among members of the Board of Directors |

Approach to Nominations

Approach to the Composition of the Board of Directors

The Company’s policy is to appoint candidates for Directors who, regardless of gender, age, nationality, etc., have excellent character, insight and ability, high ethical standards, and are judged to be able to improve the medium- to longterm corporate value of the Group and earn the trust of stakeholders, in order to provide a balance of knowledge, experience and ability for the Board of Directors as a whole.

Policies and Procedures for Appointing and Dismissing Directors at the Nomination and Compensation Advisory Committee

To appoint Directors, the Chairman and CEO proposes candidates, and the Nomination and Compensation Advisory Committee, which is a voluntary advisory body to the Board of Directors, deliberates on the proposal. The Board of Directors then gives approval, after which the candidates are submitted to the General Meeting of Shareholders for approval. The appointment of executive Directors is resolved by the Board of Directors. To appoint Directors who are Audit and Supervisory Committee members, the Company endeavors to include a person with appropriate knowledge of finance and accounting. After obtaining the consent of the Audit and Supervisory Committee, the Board of Directors gives approval, after which the candidates are submitted to the General Meeting of Shareholders for approval.

Succession Plan

(1) Develop and implement a succession plan of the CEO

The CEO shall formulate a proposal for the “ideal CEO,” including the qualities and abilities required of a CEO. The Nomination and Compensation Advisory Committee shall deliberate on the proposal and report back to the Board of Directors before it is finalized. The “ideal CEO” shall be reviewed from time to time so that it can flexibly respond to changes in the external environment.

(2) Appointment criteria and procedures

With respect to the appointment of the CEO, the CEO shall select a candidate based on the succession plan. The Nomination and Compensation Advisory Committee shall deliberate on the candidate and the Board of Directors shall decide on the candidate.

(3) Dismissal criteria and procedures

Dismissal of the CEO shall be decided by the Board of Directors when it becomes difficult for the CEO to perform his/her duties as CEO.

Executive Compensation

Basic Policy

The Company’s basic policy is to link the compensation system of Directors (excluding Directors who are Audit and Supervisory Committee Members; the same applies hereinafter) to business performance and shareholder returns in order to incentivize the improvement of the Group’s business performance and increase the corporate value over the medium to long term, as well as to set the compensation of individual directors at an appropriate level based on their responsibilities and achievements. Guided by this basic policy, the compensation of the Company’s Executive Directors includes basic compensation, bonuses, and stockbased compensation, and basic compensation is also paid to the Company’s outside Directors.

Please refer to the Corporate Governance Report posted on the Company’s website for the details of the policy for determining compensation, etc. for Individual Directors (including an overview of the monetary and stock compensation systems, as well as performance-linked compensation and the procedures for determining Directors’ compensation).

https://www.ikont.co.jp/ir/business/pdf/cgreport20250627.pdf (in Japanese)

Compensation System for Executive Directors

| Basic Compensation | Bonuses | Stock-based Compensation | |

|---|---|---|---|

| Cash/Stock | Monetary compensation | Monetary compensation | Stock-based compensation |

| Fixed/Variable | Fixed compensation | Variable compensation (linked to short-term performance) | Variable compensation (linked to medium- to long-term performance) |

| Target Ratio | 65 | 20 | 15 |

Group Governance

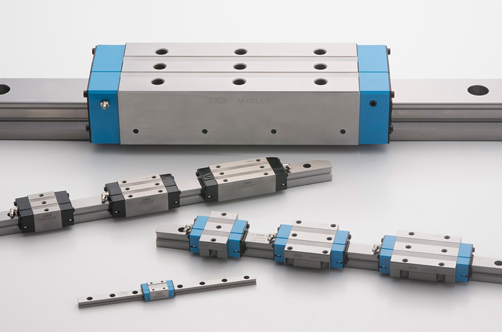

The Group, consisting of the Company and 14 Group companies (including eight consolidated subsidiaries and six nonconsolidated subsidiaries), manufactures and sells bearings and other products in Japan and around the world.

Based on the Regulations on Division of Duties, etc., the divisions under the control of the Company are given the authority and responsibility to manage affiliated companies, and they cooperate with related divisions to provide guidance and the full implementation of internal controls for the affiliated companies that they are in charge of.

The officers of affiliated companies are appointed by the Company’s Directors or senior employees, etc., to successfully execute and supervise their business operations. By reporting and discussing business operations with affiliated companies, we ensure successful business execution by sharing information and collaborate with them when necessary. The Internal Audit Department conducts internal audits of the Company and its affiliates, and then provides regular reports on the audit results to the President and COO, the Board of Directors, and the Audit and Supervisory Committee.

Decisions concerning important matters at affiliated companies are reported to the Company, the parent company, in advance. These decisions are thoroughly reviewed and approved either by the Management Committee or the Board of Directors to ensure the appropriateness of business operations at affiliated companies.

Further, for ensuring effective and smooth execution of business operations at affiliated companies, the Company has established the Affiliated Company Management Regulations to clarify the management system and operation methods of affiliated companies.

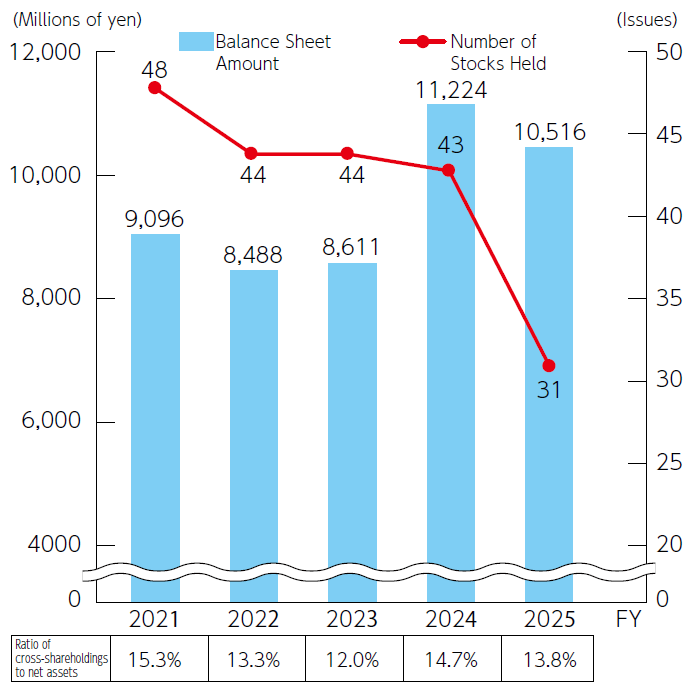

Cross-Shareholdings

Holding Policy

The Company has established internal standards for cross-shareholdings. The main purpose of cross-shareholdings is to maintain stable business relationships, and the Board of Directors annually examines the need, rationality, and other factors for retaining the holdings after comprehensively considering their stability as investment targets, among various criteria.

As a result, the Company will consider selling shares that are determined to have little significance for our holdings and will work to reduce the number of shares held.

The Medium-Term Business Plan 2026 promotes the sale of cross-held shares in order to improve our capital efficiency, aiming to reduce those shares to less than 10% of our net assets by the end of FY2027. During FY2025, we sold shares in 13 listed companies (1,599 million yen) and recorded 1,153 million yen as a gain on sales of investment securities. We plan to spend the fund gained from this sale on growth investing and shareholder returns in order to achieve sustained growth and improve capital efficiency.

Verifying the Rationality for Holding Shares

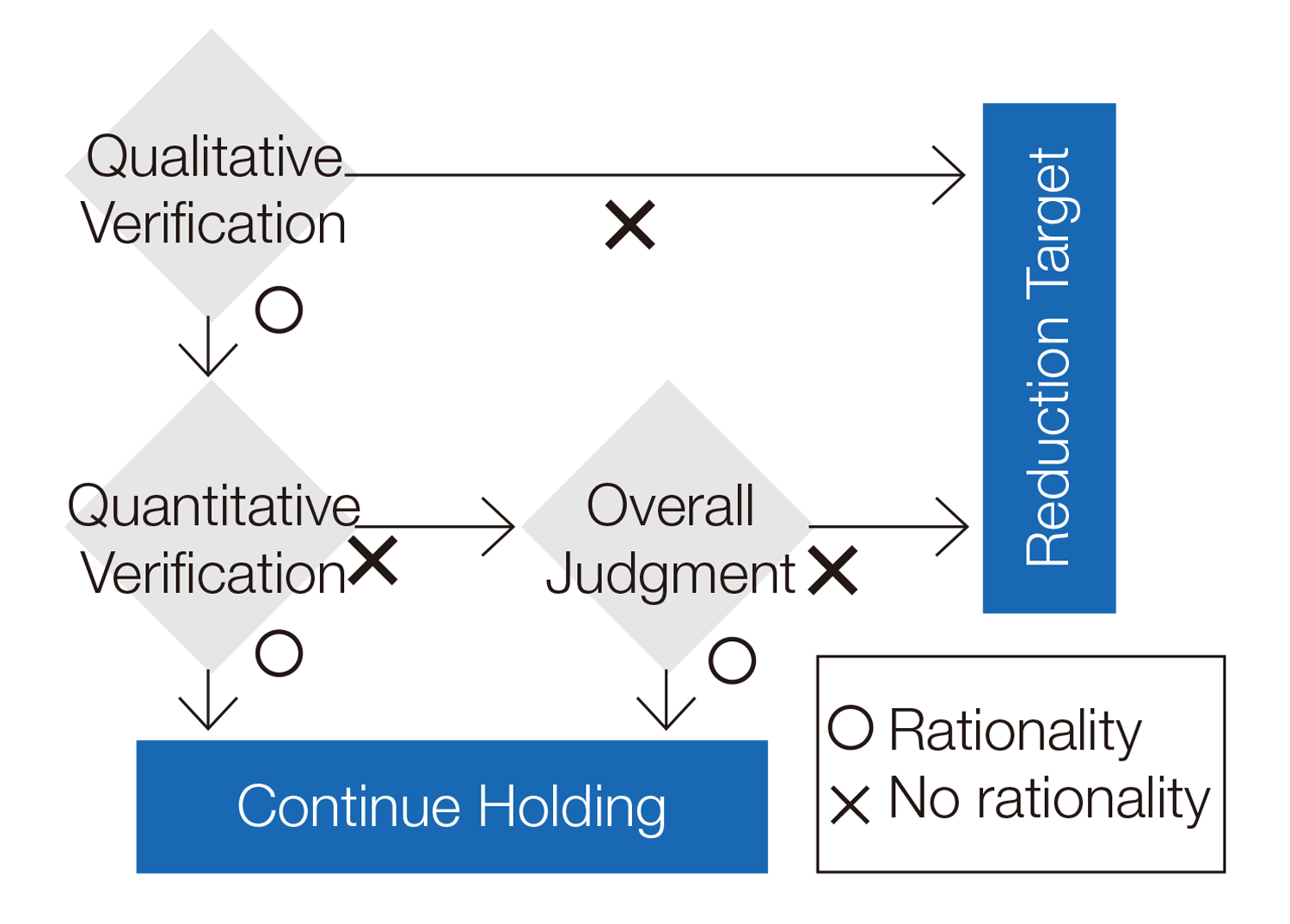

The Board of Directors annually reviews every shareholding from both qualitative and quantitative perspectives.

The qualitative verification is related to business strategies, such as maintaining smooth business relationships with customers and suppliers and ensuring that supply chains function well.

The quantitative verification relates to, for example, whether the earnings from shareholdings, including related transactions, exceed the cost of capital.