Sustainability Message from the President

President and COO

The starting point and succession of our corporate culture

When I joined Nippon Thompson, we had a new hire training for about 3.5 months that included factory internship at the Gifu factory complex. We learned from many senior employees by visiting various business sites and departments. Since joining the Company, I have strongly felt that Nippon Thompson is a company that emphasizes honesty and sincerity in conducting business. This sincerity symbolizes the IKO Group’s corporate culture that has been passed down over the generations till today.

We rarely catch people’s eyes with flashy advertisements, but we have established a firm position as a manufacturer of important mechanical components with the mission of sincerely responding to customers’ requests. We have been precisely responding to each and every high-level, complex, technological requests from our customers, and I believe that this business attitude has allowed us to build long-lasting trust with them, and has primarily differentiated us from our competitors.

This corporate culture is not just a tradition, but is the foundation that supports our sustainable growth. Sincerity will continue to be the core of our business and we will proactively incorporate flexible, next generation ideas to improve our unique products and services. Passing on this corporate culture across generations and further evolving it—this is the important mission entrusted to me.

Management philosophy and approach to challenges

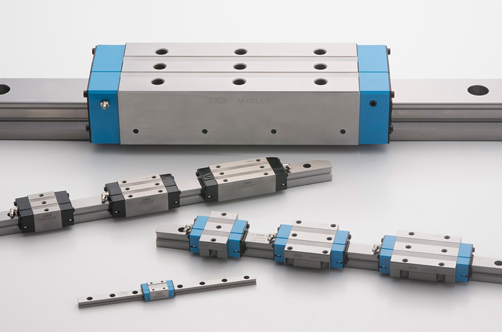

Under its management philosophy of “A Company Centered on Technology Development that Contributes to Society” and its trademark of IKO(innovation, knowhow, and originality), the IKO Group, since its inception, has aimed to become a company that is indispensable for society and customers besides offering outstanding products. The products we have customized according to our customers’ needs account for about a half of overall net sales. Our commitment to meeting diverse and sophisticated requirements is the source of our originality and competitiveness.

However, we cannot rest on our laurels. Enhancing our ability to customize and develop new products has always been a challenge. We need to further increase global competitiveness by reviewing development and sales strategies for each region to respond to the rapidly changing market. I worked in the frontline of the Sales Department through my early 40s and directly listened to many customers’ voices. After that, I served in various positions at the Management Department, such as personnel affairs and corporate planning, and nurtured a multifaceted outlook combined with the ability to make proposals and ensure coordination. These experiences, I believe, give me significant strength to fulfill the leadership role of the Group.

Working with greater speed remains a challenge for us. We experienced difficulties in addressing sudden surges in demand. With the establishment of the new R&D base in China in August of this year, we now have a structure to gather information and develop products locally and also to respond swiftly to changes in the market. During my most recent visit to a customer in China, our products were highly regarded after I explained their superiority to the officer in charge of technology who was dissatisfied with other companies’ products. It once again reminded me of the importance of having direct dialogues with customers on the marketing frontlines to find out what are the challenges they face and what they would like to do in the future. I would like to visit our business partners as many times as possible to swiftly grasp their needs for our management in the future.

The IKO Group’s vision for 2030, IKO VISION 2030, has set forth a goal of raising overseas net sales ratio to 60% or more. We believe it is essential for the Group to promote global expansion with greater speed. To this end, we will break free from excessive reliance on local entities to drive forward companywide marketing and human resource deployment, and accelerate new product development from the customers’ perspective. Through these efforts, we aim to always remain the company of choice for customers and achieve sustainable growth.

Management conscious of cost of capital and stock price

We consider “management conscious of cost of capital and stock price,” which is sought by the Tokyo Stock Exchange, to be an important issue. To improve the P/B ratio, we need to improve ROE by boosting profitability and reduce cost of capital by stabilizing financial performance. We emphasize dialogue with shareholders and investors and enhance information disclosure for this reason. IKO VISION 2030 targets a consolidated net sales of 100 billion yen or above, an operating profit of 15 billion yen or above, and an ROE of 10% or above, as we aim for a level that exceeds cost of equity (8 to 9%).

While the Group’s performance is easily affected by the electronics-related demand, the transportation equipment field accounts for only a few percentage points, and any decline in demand for auto parts caused by electrification has only a very limited impact. Our products are being increasingly used in semiconductor manufacturing equipment, which is expected to grow significantly, and in medical equipment, for which demand is expected to be stable. We have successfully differentiated ourselves from rivals, particularly in the high-end market, with our high-precision, high-quality products. We aim to develop a stable profit model by expanding sales of high-value-added products to avoid price competition as much as possible. With this profit model, we hope to win the support of shareholders and investors. I will explain the strengths and growth strategy of the Group in detail to investors and customers through continued active dialogue and engagement and reflect their opinions in management.

Appreciation of employees, who are our biggest strength

Protecting the inherited sincere and honest corporate culture alone will not be enough to ensure sustainable growth. We must also actively incorporate flexible ideas and new approaches of the younger generation. Young employees are not bound by preconceived notions and have the strength to express their opinions freely. I was also able to grow because I was given assignments with responsibility and opportunities to speak up as a young employee. I would like to offer similar opportunities to the next generation and reflect their ideas and ingenuity in management. The key to human resource utilization is development of a workplace environment that allows employees to demonstrate their individual abilities. Cross-department coordination and human resource development vitalize the entire organization, and the top management’s visits to the field to listen directly to employees allow them to maximize their potential abilities.

Currently, I am visiting business sites in Japan and abroad and exchanging views with employees regarding issues in the field and listening to their proposals for improvement. During this process, I learned of the need to improve delivery time and enhance new products from employees in the marketing field, and I truly feel that firsthand opinions can move management. I will continue to proactively visit business sites and widely leverage the opinions of employees in management. Employees are our biggest strength. I will further solidify the foundation by sincerely listening to the employees’ opinions and make optimum decisions by pooling the wisdom of the entire organization.

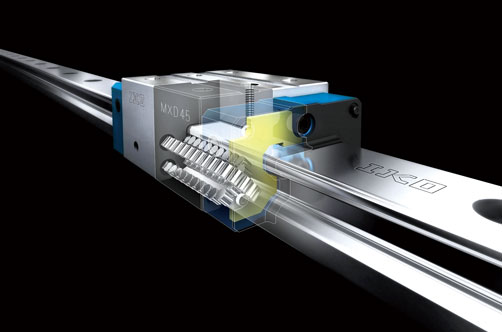

Our competitive edge built on our responsiveness and technical capability

The IKO Group is small in sales compared with major bearing companies, but its strength lies in its ability to respond meticulously, leveraging its position. We have been flexibly responding to customization and small-lot orders corresponding to customer requests, and have been accepting orders for even a single unit in some cases. This approach has the issue of efficiency but has built relationships of trust with customers, differentiating us from our rivals.

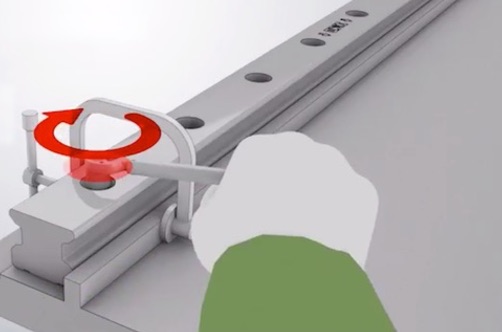

Simply put, the feature of our business model is our emphasis on ability to respond. Major manufacturers operate on the premise of efficient mass production. We, on the other hand, actively respond to difficult requests, which other companies hesitate to take on, and place importance on solving the problem. In this process, we spare no efforts even if we are viewed as unsophisticated, and this very attitude is what differentiates us from others. The ability to respond meticulously is not limited to the Sales Department. Sales Engineering, Technology Development, and Production Departments also strive as one unit to respond to orders with short delivery time or other highly complex problems. This companywide response builds better trust, allowing us to demonstrate our strengths in areas where other companies cannot easily enter.

One feature that supports this business model is having an appropriate level of inventory. While we maintain a minimum level of inventory required to respond to customers’ sudden requests, we avoid waste through market research and dialogues with customers. We also share the information gained from marketing with the Engineering Department to promote product development based on true needs. Further, we work closely with partner companies in fields where we cannot respond alone and offer integrated solutions such as Mech-unit products. We are also pursuing joint research with universities and research institutes and building a structure for creating new products starting from basic research. This approach of enabling both efficiency and flexibility is a strength unique to the IKO Group, offering reliability to customers. We will continue to evolve this business model and offer high-value-added products and services without being dragged into simple price wars.

Revision of Medium-Term Business Plan 2026 and enhancement of shareholder returns

We are aiming for sustainable growth and improvement in corporate value based on the Medium-Term Business Plan 2026. Initially, our targets were operating profit of 9 billion yen or above and ROE of 8% or above on average for three years. However, the results for the first fiscal year of the Plan and the financial forecast for the second fiscal year are now expected to fall short of the initial targets due to the delay in demand recovery in the electronics-related market, including semiconductor manufacturing equipment, and the impact of the slowdown in the European market. This is despite the presence of favorable opportunities such as the expansion in semiconductor demand for generative AI and the demand stemming from automation and manpower saving.

Considering these environmental changes, we revised the targets through FY2027 to operating profit of 6.5 billion yen or above and ROE of 8% or above. We aim to ensure profitability and growth while revising the numerical targets to achievable levels. At the same time, we are continuing with a total payout ratio of 50% or above and additionally set forth dividend on equity ratio (DOE) of 2.5% as a new standard for a minimum dividend. For FY2026, we expect to pay a record dividend of 26 yen per share, and we are on course to enhance both corporate value and shareholder returns. We also revised growth investment to 7 billion yen from the initial plan of 15 billion yen. We tweaked the investment timing considering the delay in demand recovery and postponed the construction of the new plant in Vietnam, thus maintaining the structure to respond flexibly to demand while reducing risks.

In this way, we will set forth realistic profit targets, emphasizing the balance between shareholder returns and growth investment in the Medium-Term Business Plan while responding swiftly to the changes in the external environment. We will strengthen our profitability through sales expansion of high-value-added products and by making forays into new fields as we flexibly respond to global demand fluctuations.

Challenges and strategies in growth markets

In the Medium-Term Business Plan 2026, we positioned semiconductor manufacturing equipment, industrial robots, and medical equipment as our key areas. We will focus on them as pillars for our growth. There is remarkable technological innovation going on in all these markets, where we expect to demonstrate the true value of our high-precision, high-quality products.

In the semiconductor manufacturing equipment field, demand is surging on the back of the rapid spread of generative AI. Companies are increasing capital investment, especially for server applications, and our products have been adopted widely, from wafer process to assembly and testing process. At the moment, there is more demand in the assembly and testing process, where miniature linear motion rolling guides, our strength, are effective. We have already received inquiries on next-generation models, and more and more major equipment manufacturers in and outside Japan are adopting them. The medical equipment field is where we can expect steady growth. Surgical support robots, as well as biochemical testing equipment and analyzers, require high precision, and our products are being increasingly used thanks to their high reliability. Major medical equipment manufacturers in the U.S. consider us an important supplier, and demand is expected to continue to grow in the future, due in part to the aging society. In the robot field, development of humanoid robots has been accelerating in addition to robots for industrial applications. Amid growing interest, mainly in the U.S., we are supplying crossed roller bearings used in joints. Although they are currently at the prototype stage, their mass production may start in a few years, resulting in a demand surge. The IKO Group aims to establish its place in these markets by differentiating itself from rival companies with its ability to offer high-precision, high-quality products.

In addition to these three markets, we also see growth potential in renewable energy, information and communication technology, and logistics. In particular, our products are being increasingly used in the logistics field due to progress in automation, and we can expect growth in the future. In this market, we aim to further build on our presence by expanding the scope of products we supply, from single products to mechatronics series. Our key strategy is to enter growth markets ahead of others and establish a firm footing there. We will choose high-value-added markets, where performance and quality are prioritized, as our main battleground market instead of being dragged into simple price competition for general-purpose products. This is how we aim to achieve sustainable growth.

Materiality and relationship of trust with stakeholders

The IKO Group has identified six material issues to continuously grow its corporate value through business activities and has been addressing them as issues that directly affect medium- to long-term growth. I recognize that co-creation with stakeholders, in addition to producing profits, is a critical factor in today’s corporate management.

In 2024, we established a target for greenhouse gas (GHG) emission reduction for the IKO Group and obtained SBTi certification. We aim to reduce GHG emissions by 42% or more in Scope 1 and 2 compared with FY2023 and by 25% or more in Category 1 of Scope 3 by FY2031, achieving carbon neutrality by FY2051. We are driving forward group-wide awareness reform and reviewing business processes while working on innovations in product development and production. On the social front, we attach importance to various stakeholders such as customers, shareholders, business partners, employees, and local communities. We will build a strong supply chain with business partners to maintain stable supply, with the aim of remaining the company of first choice for our customers. To contribute to local communities or future generations, we continue engaging in community-based initiatives such as participating in cleaning activities and local events as well as making donations at overseas business sites. We consider these initiatives as our mission along with ensuring corporate continuity. In terms of governance, we shifted from a company with an audit and supervisory board to a company with an audit and supervisory committee in June 2025 to increase the speed of decision-making and strengthen the supervisory function. Seven out of our 11 directors are outside directors, and we now have a diverse and transparent structure that also includes personnel with ample management experience and female directors. This is also linked to one of our material issues, “continuously improve compliance and governance,” and we consider it an important factor for improving corporate value.

As I have explained, materiality-related initiatives and co-creation with stakeholders are directly linked to the long-term improvement in corporate value of the IKO Group. We will achieve sustainable growth as “A Company Centered on Technology Development that Contributes to Society” by addressing both environmental and social issues while reinforcing our management foundation. I would like to ask our stakeholders for their continued understanding and support.

※This message is reproduced from "the Message from the President" in the Integrated Report 2025.